City Eliminates Administrative Sanctions for Seven Types of Taxes

Reported by Adriana Megawati | Translated by Maria Inggita

Jakarta Government has issued policy to eliminate administrative sanctions for seven types of taxes. Besides, there is also relaxation for two types of taxes.

Tax relief is given if there are no arrears in the previous year and the payment is before December 30

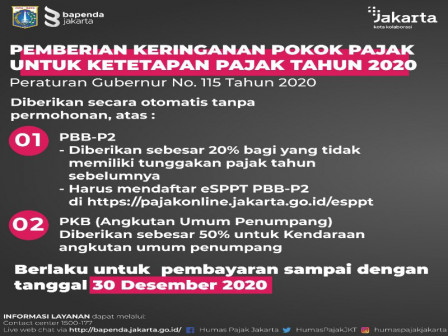

This policy is mentioned in Gubernatorial Regulation (Pergub) No. 115/2020 concerning Administrative Sanctions Abolition in 2020.

Here are Steps to Extend Billboard Permit Via OnlineJakarta Bapenda Head, Mohammad Tsani mentioned, those seven types of taxes are hotel tax, restaurant tax, parking tax, entertainment tax, billboard tax, PBB-P2, vehicle tax (PKB). Especially for PKB, it is only intended for public transportation.

"But we don't eliminate the tax base. We will delete it automatically without application until December 30, 2020," he said, Wednesday (12/16).

Meanwhile, there are additional policies for PBB-P2 and vehicle tax for public transportation where there is 20 percent tax deduction for PBB-P2 and 50 percent tax deduction for motor vehicle tax.

"Tax relief is given if there are no arrears in the previous year and the payment is before December 30," he conveyed.