Bapenda Implements e-SPPT PBB-P2

Reported by Aldi Geri Lumban Tobing | Translated by Maria Inggita

Jakarta Regional Revenue Agency (Bapenda) will implement regional tax digitalization policies in 2021, one of them is related to electronic notification of Tax Due (Land and Building Tax of Urban and Rural Sector) or e-SPPT PBB-P2.

Ease of accessing local tax documents to taxpayers in the future will be the main point we offered

E-SPPT PBB-P2 will replace the previous mechanism where taxpayers manually received in printed paper through urban village office and local RT/RW administrators.

E-SPPT PBB-P2 policy is implemented according to Gubernatorial Regulation No. 23/2021 concerning Amendments to Gubernatorial Regulation No. 27/2018 on Procedures for Issuance of Regional Tax Assessment, Payment Obligations, and Notice of Tax Payable which Taxes are Determined by Governor.

Bapenda-Computer Science Center UI Collaborate to Expand Digitalization in Local RevenueJakarta Bapenda Acting Head (Plt), Sri Haryati said, Jakarta Government always reminds taxpayers to register SPPT PBB-P2 online.

"Ease of accessing local tax documents to taxpayers in the future will be the main point we offered. It will be also the strategic measure to digitize local taxes through e-SPPT PBB-P2 program this year," she mentioned, Friday (5/14).

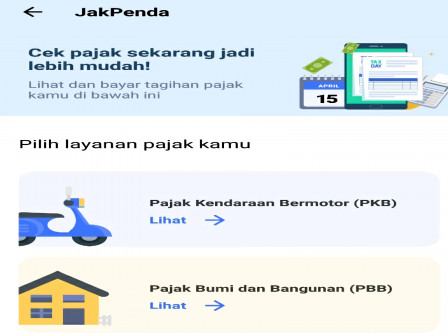

In order to get e-SPPT PBB-P2 in 2021, taxpayers should register online first, where it can be accessed through pajakonline.jakarta.go.id/esppt or JAKI application which can be downloaded on Playstore or Appstore.

Further information on Jakarta e-SPPT tutorial and registration can be accessed on Bapenda DKI Jakarta's official website at link bapenda.jakarta.go.id/2020/12/07/penyampaian-sppt-pbb-p2-dki-jakarta-tahun-2021-disampaikan-secara-elektronik-e-sppt-pbb-p2/

"Information related to e-SPPT PBB registration via JAKI application can be accessed through bapenda.jakarta.go.id/2020/12/30/aplikasi-jaki," she explained.

After that, taxpayers will get notification in their registered email after successfully registering for e-SPPT. The email contains of current year's e-SPPT PBB-P2 document.

"SPPT PBB-P2 document sent is valid document since it has been equipped with QR Code or digital marker to verify its authenticity," she stated.

Taxpayers who need SPPT PBB-P2 data in the previous year, such as PBB-P2 payment and billing data, they can access it through pajakonline.jakarta.go.id/esppt/informasi_sppt. It can be also printed if needed.

If there are problems in e-SPPT PBB-P2 registration process, including changing data listed in SPPT PBB-P2, taxpayer can contact Jakarta Bapenda call center at 1500-177 or email to callcenter.pajakdki@jakarta.go.id.

"Taxpayers can also local Regional Tax Collection Service Unit (UPPPD)," she closed.