Entertainment Tax Contribution in Jakarta Still Low

Reported by Folmer | Translated by Cintya Meliza

Contribution of entertainment tax revenue incoming to local revenue (PAD), still does not reach Rp 1 trillion yet.

There must be entertainment places in Jakarta, but why the tax is less than Rp 1 trillion?

"There must be entertainment places in Jakarta, but why the tax is less than Rp 1 trillion?," expressed Head of Jakarta Tax Service Department (DPP), Agus Bambang Setiowidodo during Socialization of Bylaw No.3/2015 about entertainment tax in Jakarta Technical Department Office, Jalan Abdul Muis, Central Jakarta, Thursday (8/27).

To reach the optimal result of the tax revenue, his department had handed over the authority of taxpayer’s data collection to sub-district's Local Tax Service Unit (UPPD).

City Keeps Pushing Tax Revenue"The assessment lies in sub-district's UPPD, as for the checking will be conducted by municipality's tax service sub-department," he uttered.

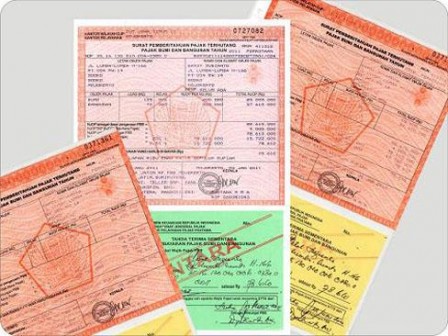

He added, of 13 kinds of tax applied in Jakarta, the most contribution for PAD are from Motor Vehicles Tax (PKB), vehicle-ownership transfer fee (BBNKB), transfer of land rights (BPHTB), Urban and Rural Land and Building Tax (PBB P2).

"So, taxpayers who want to extend annual motor vehicles tax do not need to come to Vehicle Document Registration Center (Samsat) , but only to sub-district's UPPD, except for ownership transfer and extension." Finished Setiowidodo.