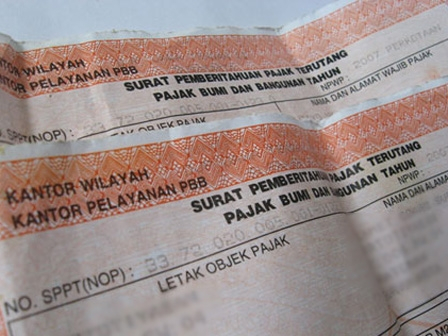

Realization of PBB-P2 This Year Exceeds the Target

Reported by Adriana Megawati | Translated by

Jakarta Regional Earnings Board (Bapenda) recorded tax realization which generated from Land and Building Tax of Urban and Rural Sector (PBB-P2) in 2020 reached Rp 6.9 trillion.

PBB-P2 realization in 2020 reached Rp 6.9 trillion from target Rp 6.5 trillion

Jakarta Bapenda Head, Mohammad Tsani Annafari conveyed, PBB-P2 is one of 13 taxes which contributed significantly for locally-generated revenue (PAD). While due date for PBB-P2 payment was last Wednesday (9/30).

"PBB-P2 realization in 2020 reached Rp 6.9 trillion from target Rp 6.5 trillion. It was collected from 556,845 personal taxpayers and 143,611 corporate taxpayers," he stated, Thursday (10/1).

City's Tax Revenue Reaches Rp 21.05 TrillionMoreover, his side also issued Tax Relaxation Policy which regulated in Bapenda Head Decree No. 2251/2020 concerning the Abolition of Administrative Sanctions for PBB-P2 for Tax Year 2020.

This policy was issued as a form of Jakarta Government's empathy to taxpayers who experienced cash flow difficulties due to interruption of business activities during pandemic period.

"This policy facilitates and provides opportunities for taxpayers to pay PBB-P2 up to 31 October without being subject to administrative sanction," he said.

Besides, taxpayers were also facilitated to pay off PBB-P2 in three stages, where the first one-third stage must be paid before October 31, 2020.

Then, the second stage must be paid before November 30, 2020. While the remaining must be paid before December 15. Taxpayers who choose payment in stages will be not subjected to administrative fines.

"This policy only applies for PBB tax year 2020 as a part of education on the compliance of taxpayers thus they can fulfill their obligation as citizens by paying taxes in accordance with applicable regulations," he explained.